During GDC 2024 in San Francisco, we hosted the Revenue Optimization in Games Mini-Summit. Industry leaders gave four fascinating presentations about revenue optimization in gaming, including an overview of the complete survey.

See our Reporting from the Game Revenue Optimization Mini-Summit follow-up post to learn more!

At Game Data Pros, a lot of our recent work on personalization has focused on what the Deconstructor of Fun podcast refers to as “Off-Platform Payments” and what Liquid & Grit calls “Web Stores”. We think it’s a big and important trend in the games industry. But how big? And how important?

To find out, we distributed a survey on LinkedIn, Twitter, and in the Deconstructor of Fun and Mobile Dev Memo communities. While this sampling approach is imperfect, it should yield decent indications of what’s happening in the marketplace. We collected a large number of responses over about two weeks. After cleaning the data from fraudulent responses based on the provided e-mail addresses and patterns in timing and response behavior, we had a sample of 26 high-quality responses across different companies and backgrounds. While that number is too small to draw conclusions, it is a good start to gather indications.

As a little introductory data point, here’s where respondents in the sample say they get their mobile gaming news (multiple responses possible):

Of course, the responses here might be impacted by how we distributed the survey. But it’s nice to see two mobile / gaming communities — that I personally trust and frequent — land in the top three.

Now, let’s dive in.

Web stores are a major market trend

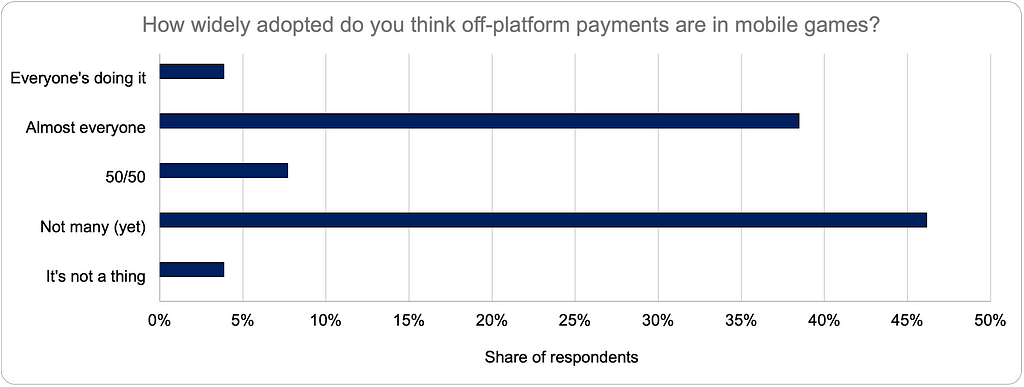

Respondents believe that the adoption of web stores in the market is far from perfect and that there is still ample potential for mobile game developers to move payments off-platform. The community is split on the question of how widespread adoption is: Half of respondents think that at least 50% of companies have started running a web store, the other half thinks that most companies are not yet doing it:

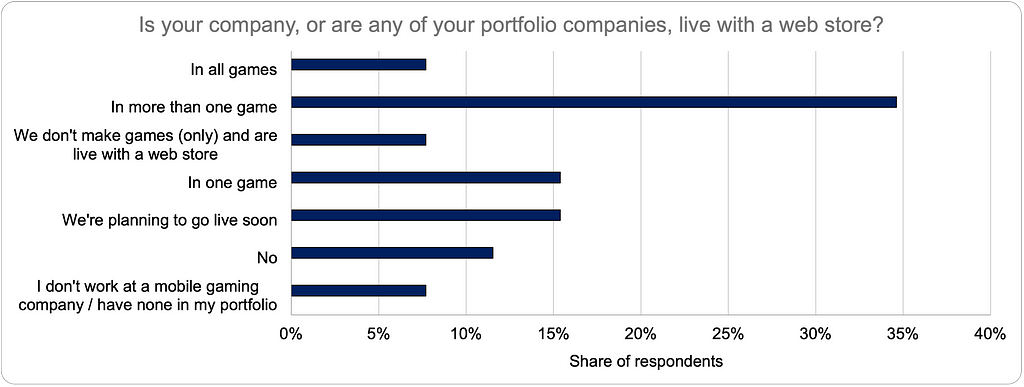

Another question we asked provides us with a more direct read:

17 respondents are live with a web store in one or more games in their company / their company portfolio. Another four indicate that they’re planning to go live soon, and three are not live and don’t seem to be planning to go live with a web store. Beliefs about adoption, i.e. the results of the previous question, may hence underestimate how many companies are actually already live with a web store.

(Side note: Our sample likely overestimates actual web store adoption as people with interest in the topic are more likely to respond.)

Off-platform payment activity expected to be significant

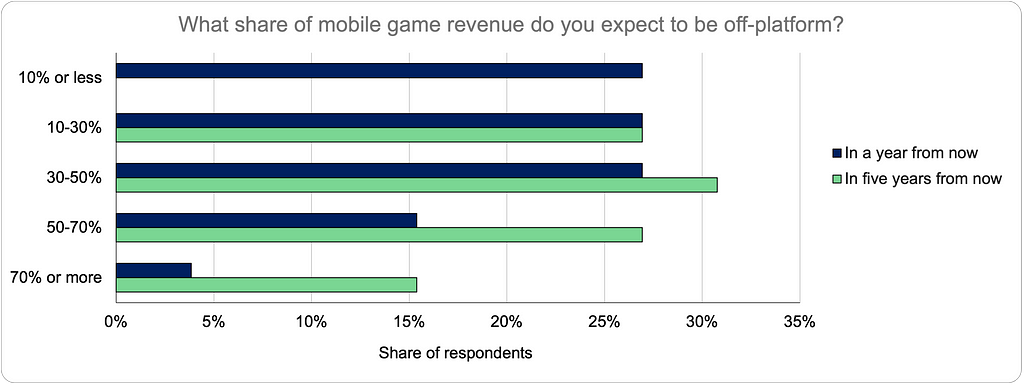

Now, being live with a web store doesn’t mean that a lot of revenue is going through it. To assess what the market thinks about the economic significance of web stores, we asked respondents for their estimates of what share of revenue will be moving off-platform in one and in five years:

Only 27% of respondents believe that only 10% or less of mobile game revenue will be off-platform in a year from now. And nobody thinks that off-platform payment activity will be that low in five years.

73% of respondents believe that 30% or more of mobile game revenue will be generated off-platform in five years. 15% even think that a staggering 70% or more of overall mobile game revenue will run through web stores in five years. Mull on that.

A windfall for game creators?

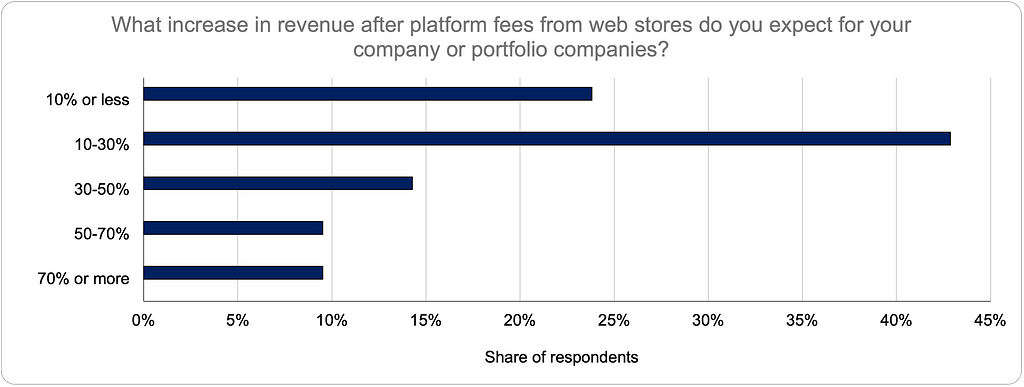

Next, we asked participants about their expectations for the revenue impact of web stores:

76% of respondents indicate that revenue after platform fees for mobile game developers will increase by 10% or more. A third thinks that the revenue windfall will clock in at 30% or more, with two respondents expecting a post-fee revenue jump of 70% plus!

The exact impact for different game developers will certainly depend on the genres and monetization behaviors in the respective publishing portfolio. If a game’s revenue is driven by a relatively small set of high-value and high-spending players, and the company very successfully entices these players to use a (personalized) web store, such outcomes seem possible. They are, however, unlikely to materialize for the broader market to this extent.

Nonetheless, these results serve to show how much is at stake. Up to 30% of overall mobile game revenue is bound to be re-distributed, by law and/or through strategic maneuvering by major market participants.

Is everybody of the same opinion?

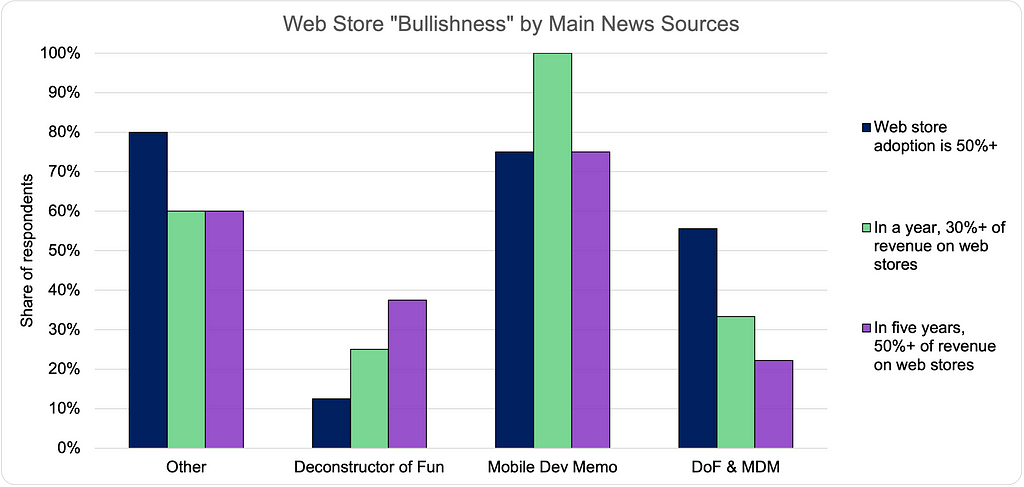

No. Opinions diverge on the importance of web stores and on what revenue share should go to content creators versus platform operators. Our sample is a little too small to slice and dice it. However, if we look at indicators of “web store bullishness” across the two most important community news sources in our sample, we notice an interesting pattern:

Respondents who list Mobile Dev Memo (MDM) as their most important source of mobile (gaming) news, appear much more bullish on web stores than respondents who primarily follow Deconstructor of Fun (DoF). 75% of MDMers think that current web store adoption sits at 50% or more while only 12.5% of DoFers think so. 100% of MDMers believe that 30% or more of revenue will go through web stores in a year from now while only 25% of DoFers do. Expectations start converging in the longer term: 75% of MDMers see 50%+ of revenue off-platform in five years, and almost 40% of DoFers agree with that perspective.

Bear in mind that these are indications at best. The sample is simply too small for anything more. They would align with this perspective though: The MDM community has on average more business-minded and less purely gaming-focused members — which seems reasonable. After all, off-platform payments may become even more critical for app developers outside gaming, such as in health, news, music, and other content distribution.

So, is this it?

And, no, again. Our survey also asked respondents about the main challenges they face in web store adoption and how they plan to overcome them. For a talk covering the full results, join us for the Revenue Optimization in Games Mini-Summit and Happy Hour on March 20, 2 pm, in downtown San Francisco. Four experts from different corners of the industry will talk about their recent work and what they see in the market. During a reception following the talks, you will have a chance to connect with the speakers and us to discuss game monetization and its future.

We’re excited to see you there!