In previous posts, we introduced the concept of revenue optimization, a strategy that has reshaped industries by harnessing data-driven decision-making to maximize profits. We traced its origins and success in various markets, highlighting characteristics that make traditional techniques particularly effective. For example, in our post “The Origins of Revenue Optimization,” we explored the foundational principles and key milestones in the evolution of revenue management across industries like hospitality and airlines. Our subsequent article, “A Brief History of Revenue Optimization: Airline Fares and Price/Time-to-Flight Curves,” examined how airlines have fine-tuned their pricing models, demonstrating a clear fit for revenue optimization in markets with predictable demand and strong historical data.

However, as any gaming industry veteran might argue, the landscape of mobile gaming is a different beast altogether. Unlike the more traditional sectors where revenue optimization has found its foothold, the mobile gaming market is marked by rapid evolution, high variability in user behavior, and a fiercely competitive environment. And that rapid evolution is occurring along three dimensions: the underlying technologies, the phone and market infrastructure, and gameplay/game mechanics. The phones keep changing, the app stores keep changing, the business models keep changing, and the definition of what a game is keeps changing.

Naturally, a gaming-oriented reader might wonder: “How could these strategies possibly apply to the chaotic world of mobile gaming?”

This post addresses that question by taking a look back at how revenue optimization took shape within mobile gaming. We’ll explore how the industry was on the verge of adopting sophisticated techniques similar to those in other sectors, only to be derailed by several major events:

- The onset of COVID-19.

- Apple’s sweeping changes to the advertising ecosystem.

- The increasing importance of compliance with privacy-oriented regimes.

COVID-19 upended market dynamics and intensified the race for market share, while Apple’s policy shifts effectively dismantled the advertising infrastructure that many gaming companies relied on for revenue generation and profitable distribution. An increasing focus on data privacy and emerging compliance requirements restricted the uses of data, particularly the ability to share datasets with third parties.

However, this is part of a larger exploration of revenue optimization in games, so let’s first step back and take a higher-level view of the emerging mobile gaming and ad network environment of the 2010s and what that meant for game optimization.

A High-Level Overview of Optimization Areas for Games

The mobile gaming industry is a complex ecosystem with multiple avenues to optimize for revenue and player experience. Each optimization area has its own specialists and tools, catering to distinct but interrelated aspects of game success.

At a high level, we can summarize six key areas for optimization in games:

- Advertising

- In-Game Ad Monetization

- Pricing and Offer Management

- Retention and Engagement

- Re-engagement and cross-promotion

- Live Operations (Live Ops)

Advertising optimization is all about discovery. With millions of games vying for attention, getting more and better users into your game is crucial. The focus here is on identifying the most effective channels and strategies for acquiring new players. This involves everything from crafting compelling ad creatives to targeting the right audience segments to analyzing ad performance to maximizing return on ad spend (ROAS). The goal is to bring in users who are likely to both install the game and engage with it long-term.

Once players are in the game, the next challenge is in-game ad monetization. This strategy focuses on deriving revenue from players via ads. Ad monetization is particularly relevant for games that don’t have in-app purchases (IAPs). In-game ad monetization involves strategically placing ads within the game that maximize revenue without detracting from the player experience. Tools like rewarded video ads, which offer in-game rewards in exchange for watching ads, are commonly used to achieve this balance.

It’s critical to understand the progression from the rise of ad networks starting in 2010-2011 to the seismic change that followed. Initially, ad networks enable developers to monetize their game by selling in-game ad inventory while also purchasing ads to acquire new players. The introduction of player identification through mobile device attribution, particularly through tools like Facebook’s and Google’s ad networks and Apple’s Identifier for Advertisers (IDFA), made it easier to track user behavior and optimize campaigns.

The depreciation of IDFA in 2021 by Apple forced a re-evaluation of these models. Advertisers struggled with limited access to user-level data, resulting in a fundamental shift in how mobile advertising works today. This marked a turning point where game publishers had to innovate and adapt to revenue optimization in a new privacy-centric environment.

Pricing optimization is a critical area for games that rely heavily on IAP. This involves determining what to sell, at what prices, and how to present these offers to players. Pricing optimization also considers player segmentation—tailoring specific offers (either by altering prices for different classes of users, like Apple’s pricing tiers, or by creating specific products and bundles for specific groups of users). The objective is to maximize revenue per user while maintaining a fair and attractive value proposition.

Game publishers need to consider important intersections between advertising optimization and pricing optimization. For instance, games that rely on in-app purchases often do not engage in significant ad monetization, leading to a natural division in the industry between the “buy side” (games that purchase ads and sell IAPs) and the “sell side” (games that sell ad inventory). However, this divide is not absolute, and some games choose to blur the lines between these two approaches, opening additional revenue opportunities. For example, there is a general belief that rewarded video, done right, improves IAPs (by giving people small amounts of currency and “teaching” them how to play the game with money).

Keeping players happy, engaged, and progressing through the game is essential for long-term success. Retention and engagement optimization focuses on crafting experiences that encourage players to stay in the game. This is often seen as the realm of game designers, focusing on game elements such as level design, playability, reward systems, and social features. However, the same analysis and optimization strategies used for ad and pricing optimization—based on statistical analysis, segmentation, experimentation, automated subgroup analysis, and personalization—can be used to reduce churn and increase the lifetime value (LTV) of each player.

Re-engagement and cross-promotion strategies play a vital role, particularly for games that have a large player base or that operate within a broad portfolio of games and other digital entertainment products. Tactics can include targeted notifications, special offers, or personalized content designed around player interests and preferences. Special offers and personalized bundles require messaging strategies that can then also be repurposed for cross-promotion when predictive analytics suggest that it is a better monetization strategy. This is why cross-promotion is sometimes called cross-selling (in analogy to upselling). Re-engagement and cross-promotion are gaining importance as the cost of acquiring new users continues rising and publishers build investments in IP franchises. Web storefronts are becoming an increasingly important consideration for re-engagement and cross-promotion strategies.

That last optimization strategy, cross-promotion, illustrates that there are two distinct lenses through which optimization can be viewed:

- Optimizing within a single game

- Optimizing across an ecosystem (most revenue optimization strategies occur here)

The former focuses on maximizing the potential of an individual title, while the latter looks at strategies that might span multiple games or platforms, considering the overall health and profitability of a developer’s portfolio or even the gaming ecosystem as a whole.

Ecosystems also have accounting entailments. If you cross-promote, you’re using ad inventory in one game to promote another game. This is a great use of the inventory in the source game (modulo predictive analytics saying it makes sense). But if the two games have different P&Ls and wind up being different ledgers with different owners, you need to have a way to divide the revenue.

Live operations, or Live Ops, refers to ongoing management and updates to a game after launch, with an eye to keeping players engaged and driving long-term revenue. Live Ops involves a sustained practice around regular content updates, special events, limited-time offers, and player-driven experiences like tournaments or seasonal activities. Live Ops enables game developers and publishers to respond to player behaviors in near-real time. Emerging Live Ops strategies employ remote configuration and the concept of “touchpoints,” which allow adjustments in optimization strategies out-of-band from game releases, transforming games into continuously evolving services rather than one-time purchases.

In future posts, we’ll dive deeper into each of these optimization areas, exploring how they evolved, the tools and techniques that have been developed, and the impact of recent market disruptions on their effectiveness.

In this post, we’ll explore ad monetization in games by reviewing the first major chapter in mobile game revenue optimization: the rise of free-to-play (F2P) games and how they reshaped the gaming landscape. We’ll examine how F2P models fundamentally shifted how publishers monetized games, relying less on upfront purchases and more on ad-based revenue. Alongside this shift came the rise of ad networks and the use of data analytics to optimize revenue. In an upcoming post, you’ll see how these ad-based strategies, after initial success, eventually faced significant challenges.

The Rise of Free-to-Play Games

Starting in 2010, F2P mobile games revolutionized the mobile gaming industry, shifting the business model away from the traditional premium content approach. Before this transformation, game developers relied on selling their titles upfront, with each player paying a one-time fee to access the full game. This model was simpler in some respects—if advertising helped acquire a player, the game developer immediately recouped their investment through the purchase. Developers didn’t need massive audiences to generate revenue because every paying customer was valuable.

The trend toward F2P mobile games was foreshadowed by the success of browser-based Facebook games. If you look at the top five Facebook games in 2010, you see the charts dominated by Zynga, which later became a mobile powerhouse. “The saying goes that all good things come to an end,” notes the YaninaGames team in The Rise and Fall of Old Facebook Games, “and this happened to these popular Facebook games eventually. Back in 2015, there was a revolution in the gaming world. One reason for the fall of old Facebook games was due to the rise of mobile games.”

The rise of F2P was transformative for mobile gaming, marked by rapid technological advancements, widespread smartphone adoption, and innovative game design. Early mobile games were relatively simple, often leveraging the novelty of touchscreen interfaces and the ubiquitous nature of smartphones.

Titles like “Angry Birds” and “Fruit Ninja” exemplified this era. The rapid user acquisition of mobile game titles like Angry Birds and Fruit Ninja was driven by their simple mechanics and quick play sessions, which appealed to a broad audience. These games required minimal learning time and provided instant gratification, making them addictive and easy to pick up and play. This simplicity allowed these games to attract millions of players globally, turning into billion-dollar franchises. The economic model of these games shifted towards free-to-play (F2P) with in-app purchases, monetizing through massive user bases despite only a small percentage of paying users.

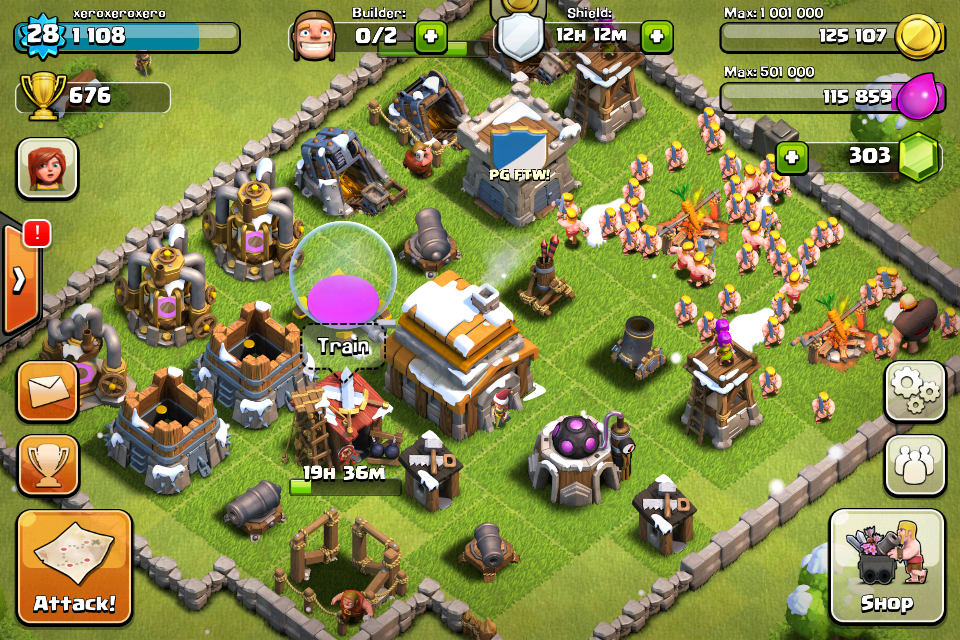

By the mid-2010s, games like “Clash of Clans” and “Candy Crush Saga” introduced more intricate gameplay mechanics, social features, and monetization strategies, laying the groundwork for new revenue models.

The rise of F2P games turned the game monetization model on its head. In a typical F2P game, around 98% of players don’t spend any money. Only a small fraction of users makes IAPs or pays for premium content. As a result, the success of an F2P game depends on reaching vast audiences, hoping that even a small percentage of them will convert into paying customers. This business model brought its own challenges—acquiring players is no longer directly tied to immediate revenue, and developers must keep their audiences engaged long enough to eventually convert non-paying players into spenders and keep them engaged to leverage repeat purchases.

Since at least 2013, the top-grossing mobile games have been overwhelmingly dominated by F2P titles. Games like “Clash of Clans,” “Candy Crush Saga,” and “PUBG Mobile” have built massive user bases by offering the game for free while monetizing through IAPs. Even games that have historically been paid, such as “Minecraft,” now feature IAPs to further boost revenue, despite an initial purchase price of approximately $6.99 (in the Apple App Store). This hybrid approach highlights how deeply F2P mechanics have embedded themselves into the industry.

As Torulf Jernström notes in a 2015 PocketGamer.biz article, “Can premium mobile games make a comeback?”:

“When looking at the top charts [in 2015], things have moved even more clearly in the direction of F2P dominance.

The current top 100 grossing chart on iOS is 99 F2P games, and Minecraft. It has been pretty consistently like that for the past 2 years.”

A turning point came around 2011 when premium content—where players paid upfront for full access to a game—was increasingly replaced by the F2P model that now dominates the industry. This shift altered how games were monetized but also influenced design decisions, leading to the rise of gameplay mechanics built around engagement, retention, and monetization through microtransactions.

I identified this shift at Scientific Revenue, as memorialized in the following slide from a joint presentation between SuperData and Scientific Revenue. During the three years from 2012 to 2015, we could clearly see a revolution unfolding in the game economy: game developers and publishers quickly pivoted from premium-priced mobile games to a market dominated by FTP games funded primarily by advertising and IAPs. (And don’t miss the other surprise here: an expansion from primarily US/EU markets to a global consumer base!)

This shift in the mobile game industry from premium to F2P didn’t just show up in slides and leaderboards, it hit the bottom line as well. Stuart Dredge reported in an April 2014 article in The Guardian that:

“Angry Birds maker Rovio Entertainment’s growth stalled in 2013, according to financial results for the year that show the company’s revenues grew by just 2.5% year-on-year….

Clash of Clans developer Supercell made $892m in revenues (£529.6m – so four times Rovio’s total) from its two mobile games in 2013, ending the year with a headcount of just 132 staff. Meanwhile, Candy Crush Saga developer King’s 2013 revenues were $1.9bn….

‘It’s pretty clear that free-to-play as a model monetises the best, but no matter what model you use, you have to make great games,’ Rovio’s marketing boss Peter Vesterbacka told The Guardian.”

The movement to FTP changed game publishing and distribution and even fundamental approaches to game design. But a common thread in the evolution of successful revenue optimization in mobile games has been the increasingly sophisticated use of user data and analytics.

A Common Thread: Data-Based Optimization

While the early days of buy-side and sell-side ad networks were effective in reaching large audiences, these early strategies lacked the fine-tuned data insights necessary to optimize either ad sales or player acquisition. Competition between gaming companies drove the evolution of a more sophisticated view of the marketplace. Even the early mobile blockbusters relied on deep insights into the game ecosystem and user preferences to optimize their success.

In a 2011 Wired profile, “In depth: How Rovio made Angry Birds a winner (and what’s next),” Tom Cheshire described some of the steps Rovio took to identify unique revenue optimization opportunities across user segments:

‘”We saw on the iPhone that paid content works,” Vesterbacka says. Consumers pay for the initial download and Rovio keeps the game fresh with updates. On Android, they saw that paid content wasn’t working, so went with an ad-supported model. It now earns them more than £600,000 monthly. In December they introduced the Mighty Eagle, a bird you can buy in-app that clears any level. Priced at 89p, it has been downloaded two million times and cost Rovio next to nothing.’

Pete Koistila, in a 2014 article “Game monetization design: Analysis of Clash of Clans” on Game Developer, provides more detail on monetization strategies used by game designers:

“In the beginning of the game you have decent amount of free gems (in-game currency, which can be bought with real money). After few hours of playing you finally run out of free gems, because you have spent all your gems to gold and elixir (two soft-currencies, which can be cheaply bought with gems). At this point your psychology about gems is already formed; gold and elixir are cheap and you have purchased those with gems. Now you need to get more gems and you would get those by purchasing via the same “Shop” where you spend all your free gems. The threshold to purchase first gems with real money is low. Clash of Clans is optimized for the first purchase with real-money.”

Developers increasingly relied on the sophisticated targeting offered by platforms like Facebook and Google to optimize user acquisition and retention. Facebook called this App Event Targeting (AEO) and Value Optimization (VO). Google had its own Universal App Campaigns (UAC). The idea was interesting: aggregate certain common events and player metrics across games and then allow game marketing teams to optimize for players who tend to do those things in other games.

Aggregating players with similar behavior in all games lowered the bar in terms of the amount of traffic required for any one game to be able to reach the critical mass to optimize with confidence. In fact, a new game doesn’t have to have any traffic at all (yet) to benefit from this. The Facebook and Google platforms could then charge a higher price to send these users to games since they are theoretically more valuable. User acquisition teams got good early results with these tools and bet hard on them.

The downside of this approach was that Facebook and Google were optimizing for outlier behavior, not normal human behavior. This made a good “jump start” for early UA results, but the good results were typically not sustained for more than a few weeks unless supported by other best practices. Teams that spent their entire marketing budgets this way, rather than diversifying their spending, couldn’t sustain the results because they lacked the data and tools to build a long-term strategy around.

The rise of more carefully constructed predictive LTV models allowed developers to estimate a player’s potential revenue contribution early, enabling real-time ad campaign optimization. This shift towards using user data increased advertising efficiency and reduced fraud by allowing developers to filter out low-quality traffic.

Overall, the successful monetization of mobile games relied heavily on leveraging rich user data and advanced analytics to create personalized, efficient, high-return advertising strategies. Mobile game revenue strategies leaned heavily on data-driven optimization. Developers started using data analytics to understand player behavior, preferences, and spending patterns. Players could be segmented based on their activity, spending behaviors, and engagement levels—even device and location. Personalized offers, initiatives, and cross-promotions could be tailored to specific player segments.

Revenue Optimization strategies were an important part of the mobile F2P landscape even in the early days of naive implementations. As time passed, better data and better algorithms made it possible to do more sophisticated and effective revenue optimization. But they also enabled better measurement (and thereby enabled faster progress because it became easier to tell which techniques worked best for which populations).

Next Steps

The rise of F2P games transformed mobile game monetization. The shift from premium, paid-up-front games to a F2P model opened the door for a wide range of new revenue strategies, with advertising and IAP at the forefront.

Over the past decade, successful mobile game publishers have increasingly relied on sophisticated data analytics to optimize these revenue streams. In future articles, I’ll take a closer look at the movement from simple ad networks to advanced predictive models developed by platforms like Facebook and Google. Leveraging user data has become a cornerstone of modern mobile game monetization. But new challenges, including Apple’s deprecation of IDFA and a growing emphasis on user privacy meant the industry would face an entirely new set of challenges.

The future of mobile game revenue optimization will depend on how effectively companies can adapt to these new constraints while continuing to use data-driven insights to drive user engagement and monetization. In future posts, we’ll dive deeper into the areas mentioned, from in-game ads to Live Ops, and discuss how they can be combined to provide a more complete perspective on revenue optimization.